2005年12月考试Paper1.2考官谈如何备考

Question 2

This question focussed on various aspects of process costing. It involved a product that passed through two processes - one where losses were incurred but there was no work in progress and the second where there were no losses but both opening and closing work in progress occurred.

Part (a) required the preparation of a process account where a normal loss and an abnormal gain were involved. Candidates generally performed very well and there were many correct answers provided.

Common errors in part (a) included:

Putting a value against the normal loss - the question clearly stated that the normal loss had no realisable value.

Crediting the abnormal gain to the process account.

Failure to provide an answer in a recognisable account format.

Part (b) - for five marks - required the valuation of completed production and the closing work in progress in the second process. In complete contrast to part (a), this was poorly done by the majority of candidates and in a significant number of cases it was not even attempted. Common errors included:

Failure to recognise that the way in which the information was presented meant that the First in First Out (FIFO) method of valuation needed to be applied.

Failure to appreciate that no equivalent unit calculations were necessary for material as all the material was input at the start of the previous process. The cost per unit that had been calculated for the previous process could be used in the valuations without adjustment. Only a cost per equivalent unit for conversion in the second process needed to be calculated and applied.

Part (c) - the written part for two marks - required candidates to explain how the disposal costs associated with a normal loss would have been recorded in the first process account. This was not well answered with the majority of candidates stating that they would be credited to the process account.

Question 3

This was a question involving linear programming for 9 marks. It was clear that candidates seemed to have been anticipating a question on this subject by the fact that they tackled it first in their answer books. On the other hand some candidates were not expecting a linear programming question and made little or no attempt to answer it. Those who made a proper attempt at this question generally provided quite good answers.

Part (a) required candidates to set out the constraints and objective function in a suitable form. Errors from weaker candidates included:

Stating the objective function in terms of total revenue rather than total contribution.

Producing constraints that muddled either kilograms or hours with values within them.

Failing to indicate the non-negative constraints.

Some candidates even tried to apply regression analysis to this question.

Part (b) required the determination of an optimal production plan in units. Both diagrammatic and calculation approaches were accepted in doing this. However, very few candidates produced the correct answer as they assumed that the optimal plan involved a combination of the two products corresponding with the intersection of the two constraint lines. The optimal plan was in fact to produce only product Y and no units of product X.

Question 4

This question examined standard costing and variances. In part (a) the requirement was to produce a statement that reconciled the standard cost of actual production with the actual cost and highlighted the total variances for the three cost elements involved. This part of the question was well answered although many candidates only calculated the three variances and did not go on to produce the reconciliation statement. Common errors included:

Failure to indicate clearly whether each variance was favourable or adverse. Candidates should realise that simply bracketing some variances and not others does not clearly indicate this.

Producing variances that compared actual costs with the budgeted costs.

Part (b), which was not answered well, required candidates to break the total fixed production overhead cost variance they had calculated in part (a) into two sub variances. This involved the calculation of an expenditure and a volume variance. Common errors included:

Having two variances that did not net back to the total variance already calculated in part (a).

Having an expenditure variance which was the same as the total variance calculated in part (a).

Having an adverse volume variance where clearly the information given in the question indicated a favourable situation (actual production was higher than that budgeted).

Incorrectly labelling the sub variances calculated.

Trying to calculate capacity and efficiency variances where there was insufficient information available to do so. In any case, these would produce a subdivision of the volume variance and not the total variance.

Part (c) required an explanation of how and why the variances calculated in part (a) under standard absorption costing would be different if standard marginal costing had been in use. No calculations were required. Many candidates correctly stated that the direct materials and direct labour variances would be unchanged but were much more vague about the fixed production overhead variance. Common errors included:

Stating that there would be no fixed production overhead variance under marginal costing.

Writing, at length, about how the profit calculated under the two costing principles could be different. This was irrelevant to the question asked and received no credit.

Ignoring the part of the requirement that asked for an explanation of why any variances would be different.

Question 5

This was an 8 mark question about absorption costing techniques. Part (a) was very straightforward and involved the calculation of two absorption rates. This was well answered by the vast majority of candidates. Common errors included:

Showing the answers as simply two values rather than as rates per machine hour or per direct labour hour, as appropriate.

Showing the rates as being ’per unit’.

Part (b) required candidates to use the rates calculated in part (a) to build up the total production cost of one unit. This was not answered well by many candidates. Previous examination questions had shown that candidates are quite good at calculating absorption rates but weak in applying them. This view was confirmed again by this time. Common errors included:

Failure to appreciate that the prime cost of the product given in the question went into the build-up of the total cost without adjustment.

Ignoring the overhead costs in cost centre W in the build-up of total cost.

Incorrectly calculating the amount of absorption where there was an hourly rate but the amount of time the product took to manufacture in cost centre T was less than an hour.

Failure to show a total production cost figure for one unit, as required.

Part (c) - the written part of this question for three marks - required an explanation of why service cost centre costs need to be reapportioned to production cost centres and an identification of which method of reapportionment fully recognises the work that service cost centres do for each other. Most candidates were able to identify the correct method of reapportionment although some referred to absorption methods rather than apportionment methods. The explanation as to why the reapportionment was necessary was often very vague. Answers were often quite long and often missed the key points.

【整理版】ACCA各科目历年真题

真题高频考点,刷题全靠这份资料

acca全科学习思维导图

梳理核心考点,一图看懂全部章节

2023年acca考纲解析

覆盖科目重难点,备考按照计划走

- acca考试怎么搭配科目?

-

建议优先选择相关联的科目进行搭配报考,这样可以提高备考效率,减轻备考压力,1、F1-F4:为随时机考科目,难度较低,这里可以自行随意选择考试顺序。2、F5-F9:如果你的工作的和财务会计或者审计有关、或者你比较擅长财务和审计的话,推荐先考F7和F8。你可以选择一起考ACCA考试科目F7和F8或者先考F7(8)再考F8(7),这就要取决你一次想考几门。3、P阶段:选修科目中,建议企业首选AFM!第二部分科目进行选择,如果AA和SBR掌握学生更好,可以通过选择AAA,如果SBL掌握的好,可以自己选择APM。

- acca一共几门几年考完?

-

acca一共有15门考试科目,其中有必修科目和选修科目,考生需要考完13门科目才能拿下证书。

- acca一年考几次?

-

acca一年有4次考试,分别是3月、6月、9月和12月,分季机考科目是采取的这类四个考季的模式,而随时机考则是没有这方面的时间规定限制,可以随报随考。

- acca的含金量如何?

-

ACCA证书的含金量是比较高的,从就业、能力提升、全球认可等角度来说,都是比较有优势的证书,其含金量主要表现在以下几个方面:1、国际化,认可度高;2、岗位多,就业前景好;3、缺口大,人才激励。

-

ACCA考试查询免考的方法是什么?ACCA免考条件是怎么要求的? 2023-10-30

-

ACCA科目一共有几门?ACCA从备考到拿证需要多长时间? 2023-10-30

-

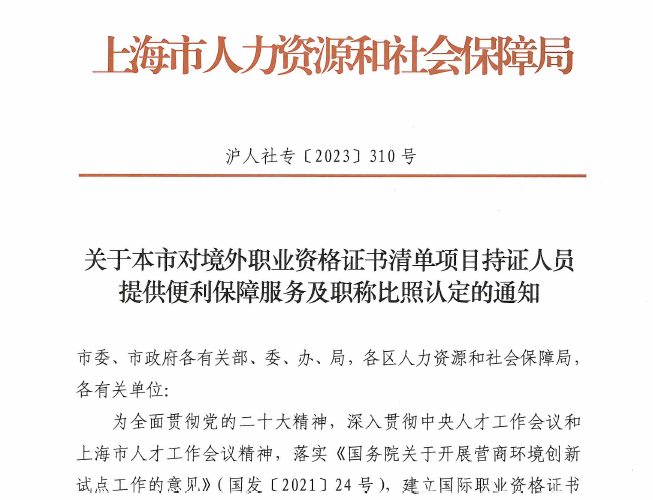

最新消息!FCCA及ACCA证书双双入选《上海市境外职业资格证书认可清单》 2023-10-20

-

昆士兰大学在校可以考acca吗?24年报读必看! 2023-10-18

-

澳大利亚国立大学在校可以考acca吗?报考详情一览! 2023-10-18

-

acca和国内注册会计师对比哪个难?一文解答! 2023-10-16

-

24年会计专业acca考试考什么?一篇文章揭晓! 2023-10-16

-

ACCA加速科目有哪些?最多可以免几科? 2023-10-16

-

澳洲悉尼ACCA加速计划是什么?留学生看过来! 2023-10-16

-

墨尔本大学ACCA加速计划是什么?一篇文章解答! 2023-10-16

-

澳洲ACCA免考是怎么规定的?详情解答一览! 2023-10-16

-

几月报考acca比较好?学姐解答! 2023-10-14

-

关于acca的详细解答,一篇文章介绍! 2023-10-13

-

报名acca都在几月?学姐解答! 2023-10-13

-

acca知识科普,新手不要错过! 2023-10-13

-

acca知识科普,新手不要错过! 2023-10-13

-

acca新手必备科普文,看这篇就够了! 2023-10-13

-

澳洲ACCA悉大加速计划攻略,考生速看! 2023-10-13

-

墨尔本大学ACCA加速计划详解,准备报考ACCA的考生速看! 2023-10-13

-

ACCA缺考有什么影响?一起来看! 2023-10-13

-

要不要报考ACCA?常见问题答疑! 2023-10-13

-

澳洲ACCA就业前景怎么样?附ACCA课程介绍! 2023-10-12

-

深度对比ACCA和CPA证书,一篇看懂! 2023-10-12

-

ACCA考试有多难?考点全面分析! 2023-10-12

-

ACCA49分有救吗?关于成绩复议一篇说透! 2023-10-12

-

进入会计师事务所应该具备哪些条件?一起来看! 2023-10-12

-

金融行业必考证书一览!你在备考哪一个? 2023-10-12

-

ACCA加速计划详解,附申请流程! 2023-10-12

-

ACCA PM备考经验分享,努力的人一定会得到一颗糖 2023-10-03

-

如何做到ACCA F阶段平均分83分?经验分享! 2023-10-02

更多服务

更多服务