CFA道德规范和专业行为准则练习题

"Morality"Exercise:Additional Compensation Arrangements

Questions 1:

Questions 1:

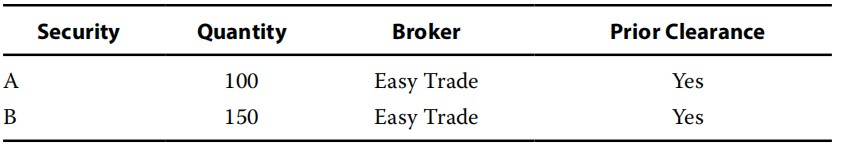

Amanda Covington,CFA,works for McJan Investment Management.McJan employees must receive prior clearance of their personal investments in accor�dance with McJan’s compliance procedures.To obtain prior clearance,McJan employees must provide a written request identifying the security,the quantity of the security to be purchased,and the name of the broker through which the transaction will be made.Pre-cleared transactions are approved only for that trading day.As indicated below,Covington received prior clearance.

Two days after she received prior clearance,the price of Stock B had decreased,so Covington decided to purchase 250 shares of Stock B only.In her decision to purchase 250 shares of Stock B only,did Covington violate any CFA Institute Standards of Professional Conduct?

A、No.

B、Yes,relating to diligence and reasonable basis.

C、Yes,relating to her employer’s compliance procedures.

【Answer to question 1】C

【analysis】

C is correct because prior clearance processes guard against potential and actual conflicts of interest;members are required to abide by their employer’s compliance procedures[Standard VI(B)].

A is incorrect because Covington did violate the Standards in that she did not follow her employer’s compliance procedures[Standard VI(B)].

B is incorrect as there is nothing to indicate she violated Standard V(A)–Diligence and Reasonable Basis.

Questions 2:

Questions 2:

Kazuya Kato,CFA,is a widely followed economist at a global investment bank.When Kato opines on economic trends,markets react by moving stock valua�tions considerably.When Kato receives information of a temporary oversupply of rare earth metals,he issues a forecast that price trends for rare earth met�als will be down significantly on a long-term basis.Kato also secretly sells his report to a widely followed Internet site.Prior to issuing this forecast,Kato emailed all portfolio managers at his bank with a copy of his report indicating that his opinion would be reversed shortly so there will be trading opportu�nities.Kato most likely violated which of the following CFA Institute Code of Ethics and Standards of Professional Conduct?

A、Market Manipulation.

B、Priority of Transactions.

C、Additional Compensation Arrangements.

【Answer to question 2】B

【analysis】

B is correct because Kato exaggerated the potential for negative price movement with rare earth metals and violated Standard II(B)–Market Manipulation by aiming to profit on the volatility created by his actions.Standard II(B)requires that members and candi�dates uphold market integrity by prohibiting market manipulation.Market manipulation includes the dissemination of false or misleading information and transactions that deceive or would be likely to mislead market participants by distorting the price-setting mech�anism of financial instruments.Standard IV(B)–Additional Compensation Arrangements was violated when he sold his report to the internet site.Standard VI(B)–Priority of Transactions has not been violated as it relates to investment transactions for clients and employers having priority over Member or Candidate transactions.

A is incorrect because Kato exaggerated the potential for negative price movement with rare earth metals and violated Standard II(B)–Market Manipulation by aiming to profit on the volatility created by his actions.Standard II(B)requires that members and candidates uphold market integrity by prohibiting market manipulation.Market manipu�lation includes the dissemination of false or misleading information and transactions that deceive or would be likely to mislead market participants by distorting the price-setting mechanism of financial instruments.

C is incorrect because Standard IV(B)–Additional Compensation Arrangements was violated when he sold his report to the internet site.

Questions 1:

Questions 1:

Questions 2:

Questions 2:

更多服务

更多服务