CFA财务报表分析练习题

"Financial Report"

Treasury stock method

Questions 1:

A retailer provides credit cards only to its most valued customers who pass a rigorous credit check.A credit card customer ordered an item from the retailer in May.The item was shipped and delivered in July.The item appeared on the customer’s July credit card statement and was paid in full by the due date in August.The most appropriate month in which the retailer should recognize the revenue is:

A、May.

B、July.

C、August.

【Answer to question 1】B

【analysis】

B is correct.The appropriate time to recognize revenue would be in the month of July because the risks and rewards have been transferred to the buyer(shipped and delivered),the revenue can be reliably measured,and it is probable that the economic benefits will flow to the seller(the rigorous credit check was completed).Neither the actual payment date nor the credit card statement date is relevant here.

A is incorrect.The order date is not relevant here because all of the critical elements in the revenue recognition process are not satisfied until July.

C is incorrect.The payment date is not relevant here because all of the critical elements in the revenue recognition process are not satisfied until July.

Questions 2:

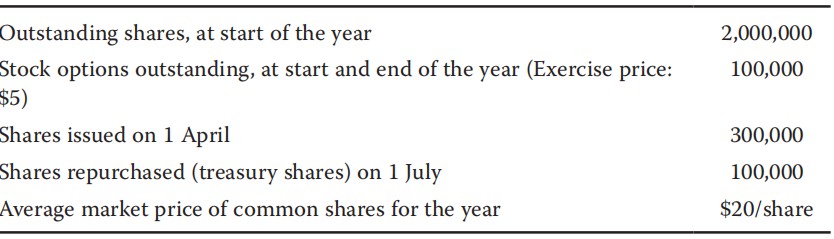

The following relates to a company’s common equity over the course of the year:

Financial Report:Treasury stock method

If the company’s net income for the year is$5,000,000,its diluted EPS is closest to:

A、$2.17.

B、$2.22.

C、$2.20.

【Answer to question 2】B

【analysis】

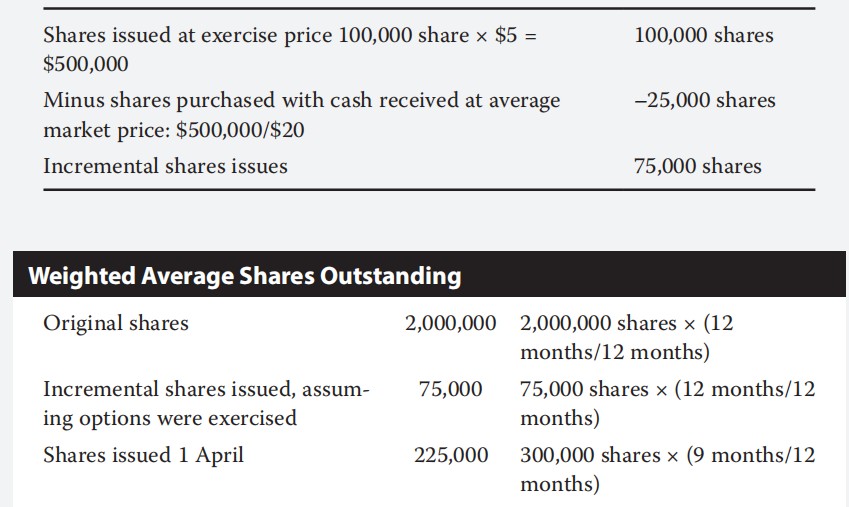

B is correct.First,determine the incremental shares issued from stock option exercise(treasury stock method):

Financial Report:Treasury stock method

Financial Report:Treasury stock method

A is incorrect.It includes the options at full value not using the Treasury stock method and forgets to prorate the others issued and repurchased$5,000,000/(2,000,000+100,000+300,000–100,000)=2.17

C is incorrect.It does not prorate the new shares issued or repurchased for the length of time outstanding:(2,000+75+300–100)=2,275;5,000/2,275=2.20.Or it ignores the buyback:(2,000+100+225–50)=2,275;5,000/2,275=2.198=2.20.

版权声明:本条内容自发布之日起,有效期为一个月。凡本网站注明“来源高顿教育”或“来源高顿网校”或“来源高顿”的所有作品,均为本网站合法拥有版权的作品,未经本网站授权,任何媒体、网站、个人不得转载、链接、转帖或以其他方式使用。

经本网站合法授权的,应在授权范围内使用,且使用时必须注明“来源高顿教育”或“来源高顿网校”或“来源高顿”,并不得对作品中出现的“高顿”字样进行删减、替换等。违反上述声明者,本网站将依法追究其法律责任。

本网站的部分资料转载自互联网,均尽力标明作者和出处。本网站转载的目的在于传递更多信息,并不意味着赞同其观点或证实其描述,本网站不对其真实性负责。

如您认为本网站刊载作品涉及版权等问题,请与本网站联系(邮箱fawu@gaodun.com,电话:021-31587497),本网站核实确认后会尽快予以处理。

更多服务

更多服务