财务报告与分析中章节的设置是循序渐进、逐层深入的,前面介绍的术语在后面还会有详细的解释与探讨。

由于财务报告与分析本身自立体系,它是上市公司和报表使用人之间沟通交流的语言,所以学起来与外语学习有几分相似。

财务报告与分析一共分为四大部分:

第一部分是扫盲阶段,主要介绍财务术语、体系等基本知识。

在此基础上,第二部分更深入地讲解财务报表编制以及财务报表分析的方法。

进一步地,第三部分针对存在利润操纵空间的重点科目做详细、深入的讨论。

最后,第四部分是前面三部分内容的综合应用。

四大部分在考试中占比最大的是第二部分和第三部分,大概占财报分析所有题目的80%以上。其次是第一部分,占比10%左右。

由于第四部分是财务分析的综合应用,不太适合一级的出题形式,所以

出题比例相对比较少,大概占5%左右。

![]() CFA财务报表分析练习题"Financial Report":liquidation profit and loss

CFA财务报表分析练习题"Financial Report":liquidation profit and loss

Questions 1:

The following information is available for an asset purchased at the start of its first year of operations(Year 1):

●Purchase price:$1.8 million

●Estimated useful life:5 years

●Estimated residual value:$500,000

If the company uses the double declining balance method of depreciation,the depreciation expense in Year 3 will be closest to:

A、$187,200.

B、$259,200.

C、$148,000.

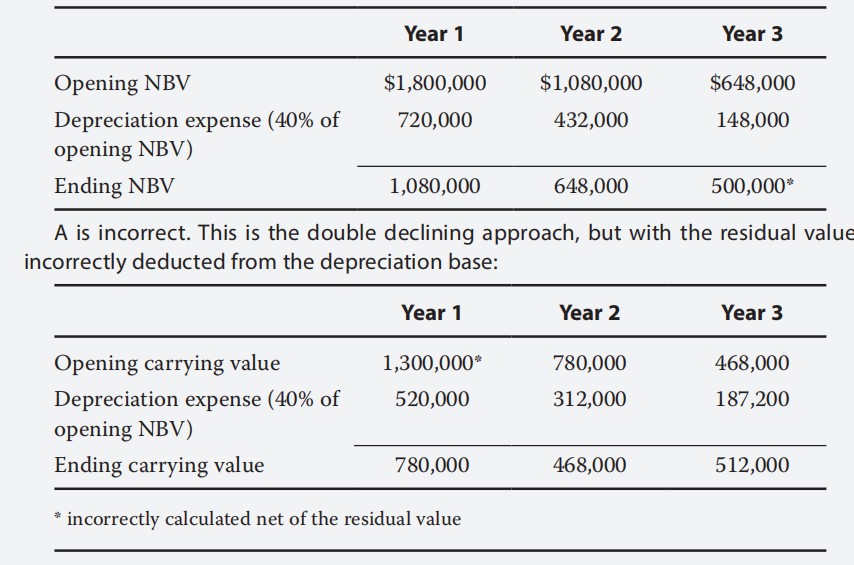

【Answer to question 1】C

【analysis】

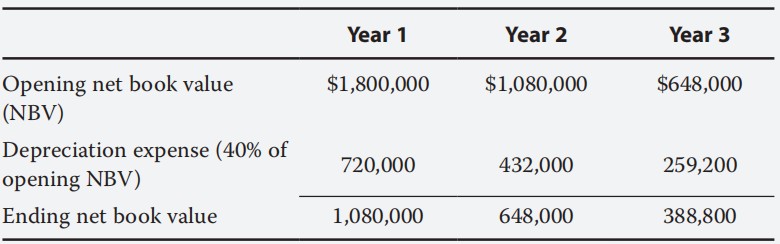

C is correct.Under the double declining balance approach,the depreciation rate applied to the carrying amount is double the depreciation rate for the straight-line method.Because the rate for the straight-line method is 20%(1/5),the double declining rate is 40%.Depreciation expense is recorded until the net book value(NBV)reaches the residual value.

B is incorrect.This is the full double declining depreciation expense that would have been recorded if the residual value had been below$388,800:

Questions 2:

Under IFRS,it is most appropriate to include which of the following pension costs of a defined-benefit plan in other comprehensive income?

A、Net interest expense accrued on the beginning net pension liability

B、Actuarial gains or losses

C、Employees service cost

【Answer to question 2】B

【analysis】

B is correct.Under IFRS,only actuarial gains or losses can be recognized in other comprehensive income.A is incorrect.Net interest expense accrued on the beginning net pension liability is recognized in profit and loss.C is incorrect.Employees service cost is recognized in profit and loss.

以上就是【CFA财务报表分析练习题"Financial Report":liquidation profit and loss】的全部内容,如果你想学习更多CFA相关知识,欢迎大家前往

高顿教育官网CFA频道!在这里,你可以学习更多精品课程,练习更多重点试题,了解更多最新考试动态。

版权声明:本条内容自发布之日起,有效期为一个月。凡本网站注明“来源高顿教育”或“来源高顿网校”或“来源高顿”的所有作品,均为本网站合法拥有版权的作品,未经本网站授权,任何媒体、网站、个人不得转载、链接、转帖或以其他方式使用。

经本网站合法授权的,应在授权范围内使用,且使用时必须注明“来源高顿教育”或“来源高顿网校”或“来源高顿”,并不得对作品中出现的“高顿”字样进行删减、替换等。违反上述声明者,本网站将依法追究其法律责任。

本网站的部分资料转载自互联网,均尽力标明作者和出处。本网站转载的目的在于传递更多信息,并不意味着赞同其观点或证实其描述,本网站不对其真实性负责。

如您认为本网站刊载作品涉及版权等问题,请与本网站联系(邮箱fawu@gaodun.com,电话:021-31587497),本网站核实确认后会尽快予以处理。

更多服务

更多服务