Questions 1:

A credit rating agency uses“scale and diversification”as one of its metrics to assess credit risk.Which of the following would most likely be included in that category?

A、Purchasing power with suppliers

B、Cost structure

C、Operating cash flow less dividends

【Answer to question 1】A

【analysis】

A is correct.Borrowers can better withstand adverse events when they have more purchasing power with suppliers.Purchasing power reflects the organization’s scale.

B is incorrect.This measure would be of interest to credit analysts,but as an indication of operational efficiency rather than scale and diversification.

C is incorrect.This measure would be of interest to credit analysts,but as an indication of tolerance for leverage rather than scale and diversification.

Questions 2:

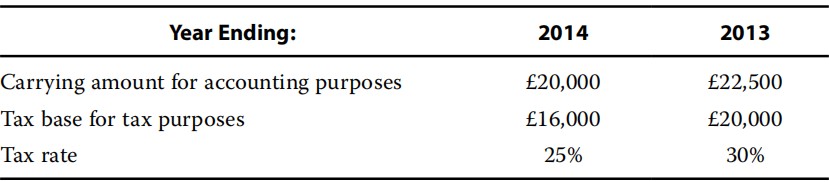

A company purchased equipment in 2013 for£25,000.The year-end values of the equipment for accounting purposes and tax purposes are as follows:

Which of the following statements best describes the effect of the change in the tax rate on the company’s 2014 financial statements?The deferred tax liability:

A、decreases by£800.

B、increases by£250.

C、decreases by£200.

【Answer to question 2】C

【analysis】

C is correct.Deferred tax liability=Taxable temporary difference×Tax rate In 2014,if the rates had not changed,the deferred tax liability would be:0.30×£4,000=£1,200 But with the lower tax rate,the deferred tax liability will be:0.25×£4,000=£1,000 Effect of the change in rate thus is a decrease in the liability:–£200 Alternative calculation=Change in rate×Taxable difference–0.05×£4,000=–£200

A is incorrect.It is the change in rate(5%)×the taxable amount:0.05×16,000=800.

B is incorrect.The deferred tax liability increased by 250:4,000×0.25–2,500×0.30.

以上就是【CFA财务报表分析练习题"Financial Report":scale and diversification】的全部内容,如果你想学习更多CFA相关知识,欢迎大家前往

高顿教育官网CFA频道!在这里,你可以学习更多精品课程,练习更多重点试题,了解更多最新考试动态。

更多服务

更多服务