Questions 1:

At the end of the year,a company r*ued its manufacturing facilities,increas�ing their carrying amount by 12%.There had been no prior downward r*ua�tion of these facilities.The r*uation will most likely cause the company’s:

A、return on assets to increase.

B、return on equity to decline.

C、net profit margin to increase.

【Answer to question 1】B

【analysis】

B is correct.The upward r*uation increases the carrying amount of the assets but bypasses net income.The r*uation is reported as other comprehensive income and will be accumulated in equity under the heading of r*uation surplus,increasing equity.This increase will cause the return on equity to decline.

A is incorrect.The upward r*uation causes an increase in the carrying amount of the assets but bypasses net income and is reported as other comprehensive income(under the heading of r*uation surplus),increasing equity.This will cause the return on assets to decline(same income,higher assets).

C is incorrect.The upward r*uation causes an increase in the carrying amount of the assets but bypasses net income and is reported as other comprehensive income(under the heading of r*uation surplus),increasing equity.This will cause Net Income/Sales to be unaffected.

Questions 2:

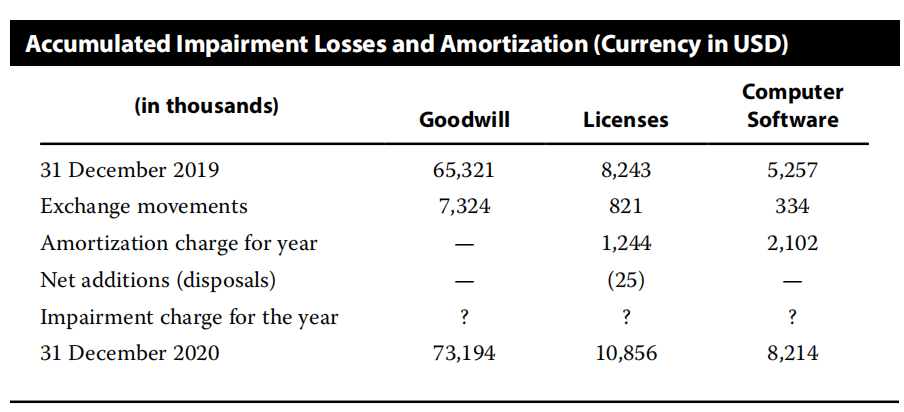

A technology company,reporting under US GAAP,has three classes of intangi�ble assets.The table below shows information on each of the three classes.:

Based on the data provided,the intangible asset that has the largest absolute impairment charge for the period ended 31 December 31 2020,is:

A、computer software.

B、licenses.

C、goodwill.

【Answer to question 2】B

【analysis】

B is correct.Licenses will have the largest dollar impairment charge on the income statement due to the size of the implied impairment charge,which is calculated as:Accumulated impairment losses and amortization as of 31 December 2019–(Accumulated impairment losses and amortization as of 31 December 2019+Exchange movements+Amortization charge for year+Net Additions(Disposals)).In this case the largest impair�ment loss that will be reported is due to licenses.Impairment charge due to licenses=10,856–(8,243+821+1,244–25)=573.

A is incorrect because the amount of the impairment charge due to computer soft�ware is less than that of licenses.The computer software impairment charge for 20X2 in dollars=8,214–(5,257+334+2,102)=521.

C is incorrect because the amount of the impairment charge due to goodwill is less than that of licenses.The goodwill impairment charge for 20X2 in dollars=73,194–(65,321+7,324)=549.

更多服务

更多服务