CFA财务报表分析练习题"Financial Report":Financial Analysis Techniques

财务报告与分析中章节的设置是循序渐进、逐层深入的,前面介绍的术语在后面还会有详细的解释与探讨。

由于财务报告与分析本身自立体系,它是上市公司和报表使用人之间沟通交流的语言,所以学起来与外语学习有几分相似。

财务报告与分析一共分为四大部分:

第一部分是扫盲阶段,主要介绍财务术语、体系等基本知识。

在此基础上,第二部分更深入地讲解财务报表编制以及财务报表分析的方法。

进一步地,第三部分针对存在利润操纵空间的重点科目做详细、深入的讨论。

最后,第四部分是前面三部分内容的综合应用。

四大部分在考试中占比最大的是第二部分和第三部分,大概占财报分析所有题目的80%以上。其次是第一部分,占比10%左右。

由于第四部分是财务分析的综合应用,不太适合一级的出题形式,所以

出题比例相对比较少,大概占5%左右。

Questions 1:

All else being equal,a decrease in which of the following financial metrics would most likely result in a lower return on equity(ROE)?

A、The tax rate

B、Leverage

C、Days of sales outstanding

【Answer to question 1】B

【analysis】

B is correct.Leverage is a component of the return on equity equation under the DuPont Analysis.If leverage decreases,so will return on equity.ROE=Tax burden×Interest burden×Earnings before interest and taxes margin×Total asset turnover×Leverage A is incorrect.The tax burden is one of the components of ROE in the 5-factor model:Tax burden=Net income/EBT=(EBT–Tax)/EBT=1–Tax/EBT=1–Effective tax rate A lower tax rate means the company keeps more of its pre-tax profits(and has a higher tax burden).

A lower tax rate increases net income and increases ROE:an increase in any of the 5 components increases ROE.

C is incorrect.Days of sales outstanding is a component of the asset turnover measure.All else equal,if days of sales outstanding decreased,total asset turnover would increase.If asset turnover increases,so will return on equity.

Questions 2:

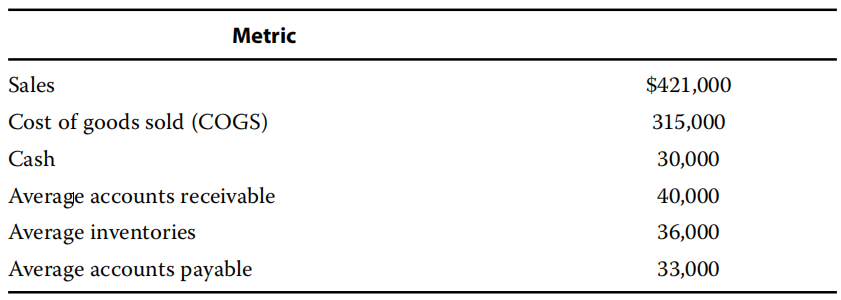

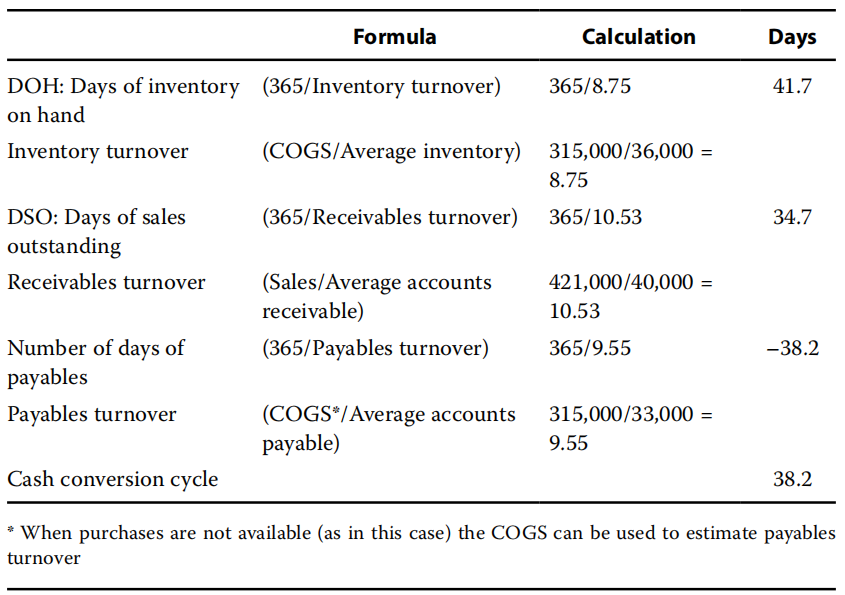

The following selected financial information is available:

The company’s cash conversion cycle(in days)is closest to:

A 76.4.

B 45.2.

C 38.2

【Answer to question 2】C

【analysis】

C is correct.Cash conversion cycle=DOH+DSO–Days of payables.

A is incorrect.This is the operating cycle;it forgot to subtract payables:41.7+34.7=76.4.

B is incorrect.It subtracted days in receivable,added days payable outstanding:41.7–34.7+38.2=45.2

版权声明:本条内容自发布之日起,有效期为一个月。凡本网站注明“来源高顿教育”或“来源高顿网校”或“来源高顿”的所有作品,均为本网站合法拥有版权的作品,未经本网站授权,任何媒体、网站、个人不得转载、链接、转帖或以其他方式使用。

经本网站合法授权的,应在授权范围内使用,且使用时必须注明“来源高顿教育”或“来源高顿网校”或“来源高顿”,并不得对作品中出现的“高顿”字样进行删减、替换等。违反上述声明者,本网站将依法追究其法律责任。

本网站的部分资料转载自互联网,均尽力标明作者和出处。本网站转载的目的在于传递更多信息,并不意味着赞同其观点或证实其描述,本网站不对其真实性负责。

如您认为本网站刊载作品涉及版权等问题,请与本网站联系(邮箱fawu@gaodun.com,电话:021-31587497),本网站核实确认后会尽快予以处理。

更多服务

更多服务