What are the total number of CFA subjects in 2024?

1. CFA Level 1 subjects and weight ratio:

Professional ethics and ethics 15-20%, quantitative analysis 8-12%, economics 8-12%, financial statement analysis 13-17%, corporate finance 8-12%, equity investment 10-12%, fixed equity investment 10-12%, derivative investment 5-8%, other investments 5-8%, and investment portfolio management 5-8%;

2. CFA Level 2 subjects and weight ratio:

Professional ethics and ethics 10-15%, quantitative analysis 5-10%, economics 5-10%, financial statement analysis 10-15%, corporate finance 5-10%, equity investment 10-15%, fixed equity investment 10-15%, derivative investment 5-10%, other investments 5-10%, and portfolio management 10-15%;

3. CFA Level 3 subjects and weight ratio:

Professional ethics and ethics 10-15%, economics 5-10%, equity investments 10-15%, fixed equity investments 15-20%, derivative investments 5-10%, other investments 5-10%, and portfolio management 35-40%.

1. CFA Level 3 exam question types: essay questions (including multiple-choice and writing questions), case analysis questions

First exam (2 hours and 15 minutes):

8-11 essay questions, including multiple-choice questions and writing questions (for example, when answering multiple-choice questions and choosing one of the investment portfolios A, B, or C, the writing questions explain the reasons for the choice.)

Second exam (2 hours and 15 minutes):

Case questions, each containing 4 or 6 multiple-choice questions, a total of 44 multiple-choice questions, each with the same score of 3 points.

The first round of the Level 3 exam consists of multiple-choice and writing questions. The questions provide some background information and data, and the questions after the questions need to be answered. Each question may be divided into several parts. The second session of the CFA Level 3 exam is a case study question, with the same format as Level II.

CFA Level 3 subjects and weight ratio:

Professional ethics and ethics 10-15%, economics 5-10%, equity investments 10-15%, fixed equity investments 15-20%, derivative investments 5-10%, other investments 5-10%, and portfolio management 35-40%. (7 courses)

4. CFA Level 3 Exam Question Types

Assessment focus: Require candidates to master knowledge of portfolio management

Structure: The Level III exam consists of a set of items, including illustrations, multiple choice questions, and question and answer questions.

Time: The computer-based exam takes approximately 4.5 hours and is divided into two parts, with an optional rest time in between.

The first part of the CFA Level III exam includes 8 to 11 questions to answer. Each paper question in the exam includes a chart, followed by some related questions that need to be answered. In the exam, there will also be some multiple-choice questions.

For example, you may be asked multiple choice questions to choose a project portfolio (A, B, or C) that meets a specific goal, and explain through an article that your choice is correct.

The score values of paper questions vary. At the beginning of each question, the total score of the article will be indicated. Due to time considerations, please spend about 1 minute on this issue.

Key Assessment Points of CFA Level 3 Exam: Portfolio Management

The third level question type has strong subjectivity and a comprehensive coverage of knowledge points. In the Level 3 exam, the focus of the exam has completely changed, so it is important to watch the video first because Level 3 emphasizes a whole, and you must integrate various knowledge points into a whole, unlike Level 1 and Level 2 exams that only focus on individual knowledge points for testing.

In the third level, it is important to combine various knowledge points, so it is necessary to first look at the third level knowledge points and form a rough overall thinking. Forming a comprehensive financial thinking is extremely important for the third level review.

If you start reading books when reviewing the Level 3 exam, even if you have finished reading the five books required for CFA Level 3, you have no idea what Level 3 is about. The Level 3 exam mainly focuses on investment portfolios, and the content related to investment portfolios is quite comprehensive.

2、 How to prepare for the CFA exam

Because CFA textbooks involve many and scattered knowledge points, it is necessary for candidates to revisit the previously learned content and focus on memorizing the key points they have marked to deepen their impression. This will also be helpful for learning new content, gradually connecting the learned content together to form a complete knowledge system.

【超详细保姆教程】CFA考试真题

真题高频考点,刷题全靠这份资料

CFA报考指南

梳理核心考点,一图看懂全部章节

CFA-L1-考纲-新版/p>

全科备考学习打卡表,备考按照计划走

- cfa证书就业岗位有哪些?

-

cfa考完后可以从事的工作包括公司会计、基金经理助理、投资管理师、股票研究分析师、基金分析师、投资产品分析师、券商助理分析师、交易员等。在全球范围内,cfa会员的雇主包括了摩根大通、汇丰银行等机构。

- cfa考试内容有哪些?

-

cfa考试分为三个等级,cfa一级和二级考试科目包括《职业伦理道德》、《定量分析》、《经济学》、《财务报表分析》、《公司理财》、《投资组合管理》、《权益投资》、《固定收益投资》、《衍生品投资》、《其他类投资》。cfa三级考试科目包括《经济学》、《投资组合管理》、《权益投资》、《职业伦理道德》、《固定收益投资》、《其他类投资》、《衍生工具》。

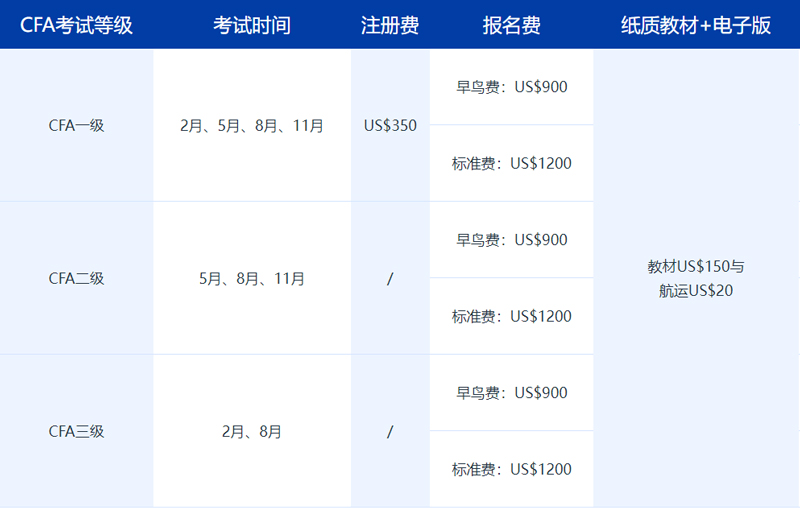

- cfa一年考几次?

-

cfa每年考试的次数每个级别均有不同,其中CFA一级考试每年设置四次,CFA二级考试每年设置三次,CFA三级考试每年设置两次。需注意,协会规定考生必须要按照CFA考试的三个级别,依次进行报考,且报考两个级别考试的窗口之前需至少间隔6个月。

- cfa的含金量如何?

-

CFA证书全称Chartered Financial Analyst(特许注册金融分析师),是全球投资业里最为严格与高含金量资格认证,为全球投资业在道德操守、专业标准及知识体系等方面设立了规范与标准,具有较高的知名度和影响力。 英国的国际学术认证中心,还将持有CFA证书视为拥有硕士学历水平,能让想进修的金融专业人士,充分学习等同于金融硕士的知识课程。此外,人民日报三年内连续四次推荐CFA证书!因此,无论是从国际知名度还是国内知名度来说,CFA资格认证的含金量和认可度都是非常高的。

更多服务

更多服务