What is the date of the 2024 CPA US exam?

CPA Evolution is just around the corner. Have you heard of the CPA Evolution initiative? Are you aware that the Uniform CPA Examination (CPA Exam) is changing significantly in January 2024? It is important that you learn about this initiative and the upcoming changes to the CPA Exam to fully understand how it might impact your journey to CPA licensure.

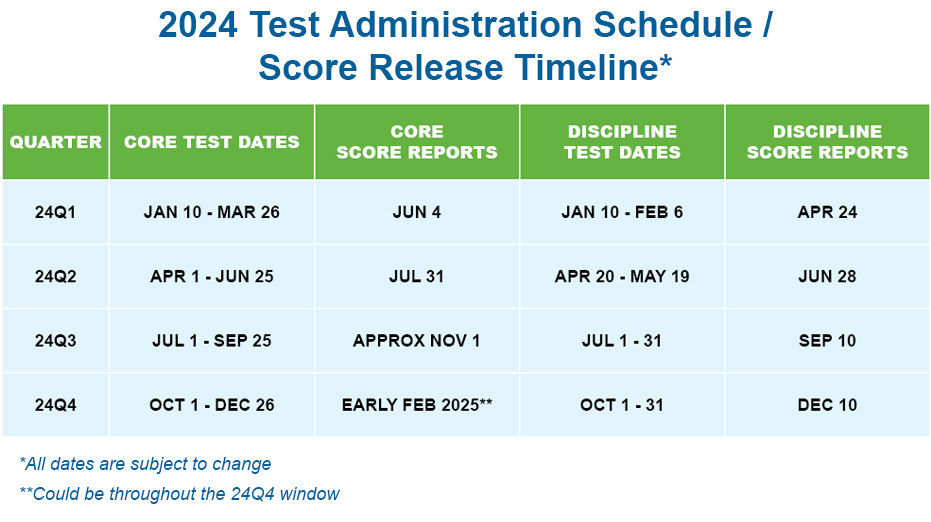

一、Important 2024 Administration Dates

AICPA has published the tentative 2024 CPA Exam testing schedule and score release schedule. Please note that these dates are tentative pending further review by AICPA.

It is anticipated that testing will commence on January 10, 2024, for all sections. While the core sections (AUD, FAR and REG) will first be available for scheduling through March 26, 2024, in the first quarter of 2024, the discipline sections (BAR, ISC and TCP) will be available through February 6, 2024. Scores are anticipated to only be released once per test section per quarter due to necessary standard-setting analyses and activities.

二、Boards of Accountancy Considering Credit Extension and Other Relief

Due to the limited testing schedule and delayed score releases in 2024, the CBT Administration and Executive Directors Committees of NASBA have recommended a policy to Boards of Accountancy for consideration, which would allow candidates with Uniform CPA Examination credit(s) on January 1, 2024, to have such credit(s) extended to June 30, 2025.

Each Board of Accountancy must individually consider if it wishes to adopt such a policy. NASBA has published a map on its website, which will be updated as boards consider the policy. To date, 39 jurisdictions have already approved the policy. Others will be reviewing it at upcoming board meetings. In some states, the board may be favorably inclined to adopt the policy, but legislative rule making may be required, which could take some time.

Boards of Accountancy will also be asked to consider a rule change that is currently under exposure for comment. It is anticipated that the model rule under the Uniform Accountancy Act, could be available in final form by early 2023. Such a rule, if adopted by a Board of Accountancy, would shift the start date of the 18-month credit period to the date a passing score was released by NASBA to the candidate or a board. Currently, many boards utilize earlier dates such as the date a candidate tests. If adopted, this could provide additional relief to candidates. Each board must decide whether or not to change their rules. This will be a longer-term initiative, as rule changes can take some time, depending on the jurisdiction. NASBA will develop and publish a map showing jurisdictional rules on this topic in the near future.

三、Transition Policy Reminder

The new CPA licensure and CPA Exam model is a Core and Discipline model. In February 2022, a transition policy was announced. This policy lays out how CPA Exam sections passed under the current CPA Exam map to credit under the 2024 CPA Exam. Candidates who will start taking the CPA Exam in 2023 but continue to take sections in 2024 should review this policy and the FAQs on NASBA’s website.

USCPA教材试读-REG

真题高频考点,刷题全靠这份资料

USCPA-REG学习思维导图

梳理核心考点,一图看懂全部章节

USCPA考试公式大全

突破计算瓶颈,节省考试时间

- 美国注会考试考多少分及格?

-

uscpa一共有四门科目,每门考试的满分为99分,75分及格,但是这个75不是75%的正确率,不能被理解为百分比。

- uscpa一共几门几年考完?

-

uscpa总共考4门,一般单科成绩的有效期为18个月,大家需要在这个有效期的时间内,通过剩余的三门科目,否则第一门通过的考试成绩就作废,需要重考。因此,uscpa考试周期最长为18个月。

- uscpa一年能考几次?

-

NASBA和AICPA开启了连续测试期后,大家可以不受限制的全年参加uscpa考试。在uscpa的考试成绩公布后,如果大家发现自己没有通过考试,能够马上申请并参加该门科目考试,也不用再等待下一个考季才能申请重考。

- uscpa的含金量如何?

-

uscpa是美国正式的注册会计师国家资格,在美国拥有审计签字权,作为美国财经领域的三大黄金证书之一,在国内外都有着很好的知名度。很多外企招聘财务经理或财务总监岗位,都将持有uscpa证书作为优先录用条件。

-

uscpa培训哪个机构比较好?什么时候考? 2023-11-09

-

aicpa培训班有什么优势?报哪个机构更好? 2023-10-11

-

2024年USCPA含金量如何?国内有哪些福利政策? 2023-09-25

-

2024年美国CPA考几门科目?一文带你了解 2023-09-22

-

2024年USCPA成绩有效期或顺延至2025年! 2023-09-22

-

考生必看:2024年USCPA考试改革内容详解 2023-09-21

-

速看:你一定要知道的USCPA考试时间节点 2023-09-14

-

NASBA系统调整!uscpa报名将有哪些变化? 2023-09-11

-

考生必看:2024年uscpa报名和培训费用详解 2023-08-14

-

2024年美国CPA考试蓝图正式发布:点击了解详情! 2023-08-09

-

2024年BEC科目大变革:新科目有哪些特点? 2023-08-09

-

2024年USCPA考试时间公布:点击查看! 2023-08-06

-

2024年USCPA改革:考试科目有什么变化? 2023-08-05

-

速看!2023年USCPA考试改革重要时间节点汇总! 2023-08-04

-

速看!2023年USCPA考试改革重要时间节点汇总! 2023-08-04

-

2024年USCPA考试科目:一分钟带你全面了解 2023-08-02

-

新手速进:2024年USCPA考试科目有几门? 2023-08-02

-

纽约州uscpa报考要求有哪些?考试费涨了吗? 2023-07-31

-

uscpa考试费用涨到多少了?254.8美元/科! 2023-07-31

-

定了!uscpa考试费用上涨至254.8美元/科! 2023-07-31

-

USCPA考试成绩多久有效?查询方式是什么? 2023-07-29

-

2024年美国cpa考试各项费用一览:点击了解 2023-07-27

-

2023年uscpa考试时间表!附考试地点安排 2023-07-18

-

uscpa跟aicpa有什么区别?点击查看详情 2023-07-18

-

USCPA考试科目有哪些 2023-07-18

-

美国注册会计师uscpa考试形式介绍 2023-07-18

-

美国cpa学分认证机构有哪些?收费标准如何? 2023-07-04

-

美国CPA学分认证机构大揭秘:附学分认证详解 2023-07-04

-

aicpa是什么证书?考了方便留美吗? 2023-07-03

更多服务

更多服务