CFA财务报表分析练习题"Financial Report":Lease agreement

Questions 1:

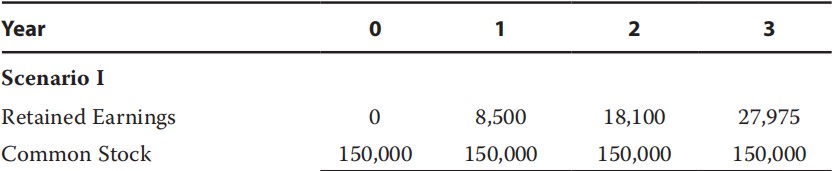

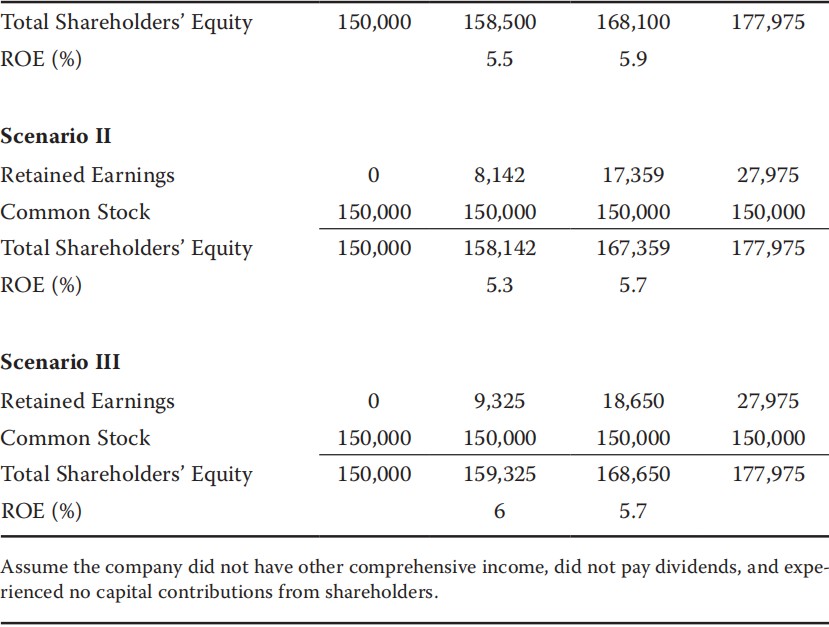

The following table represents selected financial statement data for a company given three different scenarios:

Using the data provided in the table to calculate ROE in Year 3,in which sce�nario is the company most likely a lessee in a finance lease?

A、Scenario I

B、Scenario II

C、Scenario III

【Answer to question 1】B

【analysis】

B is correct.A company that enters into a finance lease as the lessee reports an asset(leased asset)and related debt(lease payable)on the balance sheet.On the income statement,the company reports interest expense on the debt,and if the asset acquired is depreciable the company reports depreciation expense.Return measures are typically lower in early years for a lessee in a finance lease and rise over the course of the lease,all else equal.In this case ROE is calculated as net income divided by average shareholders’equity.Scenario II is the only scenario in which the company’s ROE is rising over time.In Scenario II,the company had year 3 ROE of 6.1 percent:(27,975–17,359)/[(177,975+167,359)/2].

A is incorrect because the ROE pattern is not representative of a lessee in a finance lease.In Scenario I,the company’s year 3 ROE is 5.7 percent:(27,975–18,100)/[(177,975+168,100)/2].

C is incorrect because in Scenario III the company’s ROE is declining over time,which is not indicative of a lessee in a finance lease.In this case,year 3 ROE is 5.4 percent:(27,975–18,650)/[(177,975+168,650)/2].

Questions 2:

An advantage to the lessee in a leasing agreement is most likely:

A、economies of scale in servicing assets.

B、tax benefits associated with interest expense.

C、lower financing costs than purchasing the asset.

【Answer to question 2】C

【analysis】

C is correct.Leases can provide less costly financing for the lessee because they usually require little,if any,down payment and often are at lower fixed interest rates than those incurred if the assets were purchased.

A is incorrect because economies of scale in servicing assets is an advantage for the lessor,not the lessee.

B is incorrect because tax benefits associated with the interest expense is an advantage to the lessor,not the lessee.

更多服务

更多服务